It’s been a topic hot on the minds of running political candidates, employers, and the Obama administration alike—whether to keep the Cadillac Tax on premium health care plans or to repeal it—and now it’s been officially delayed until 2020 with widespread bipartisan support in Congress. What’s all the debate about? It’s about how to control costs and spending on health care. Health care reform wasn’t just about creating better care incentives, it was also about controlling costs that were skyrocketing. On October 1, 2015, 101 economists and analysts issued a letter to Congress asking them not to repeal the Cadillac Tax despite growing opposition to it. Why? If not replaced with another form of tax reform on health care plans, it will defeat the very purpose it was put in place—to stop unreasonable spending and control sky high deficits, which the economists predict would climb to an estimated $91 billion over the next decade according to the Joint Committee on Taxation. Ouch.

It’s been a topic hot on the minds of running political candidates, employers, and the Obama administration alike—whether to keep the Cadillac Tax on premium health care plans or to repeal it—and now it’s been officially delayed until 2020 with widespread bipartisan support in Congress. What’s all the debate about? It’s about how to control costs and spending on health care. Health care reform wasn’t just about creating better care incentives, it was also about controlling costs that were skyrocketing. On October 1, 2015, 101 economists and analysts issued a letter to Congress asking them not to repeal the Cadillac Tax despite growing opposition to it. Why? If not replaced with another form of tax reform on health care plans, it will defeat the very purpose it was put in place—to stop unreasonable spending and control sky high deficits, which the economists predict would climb to an estimated $91 billion over the next decade according to the Joint Committee on Taxation. Ouch.

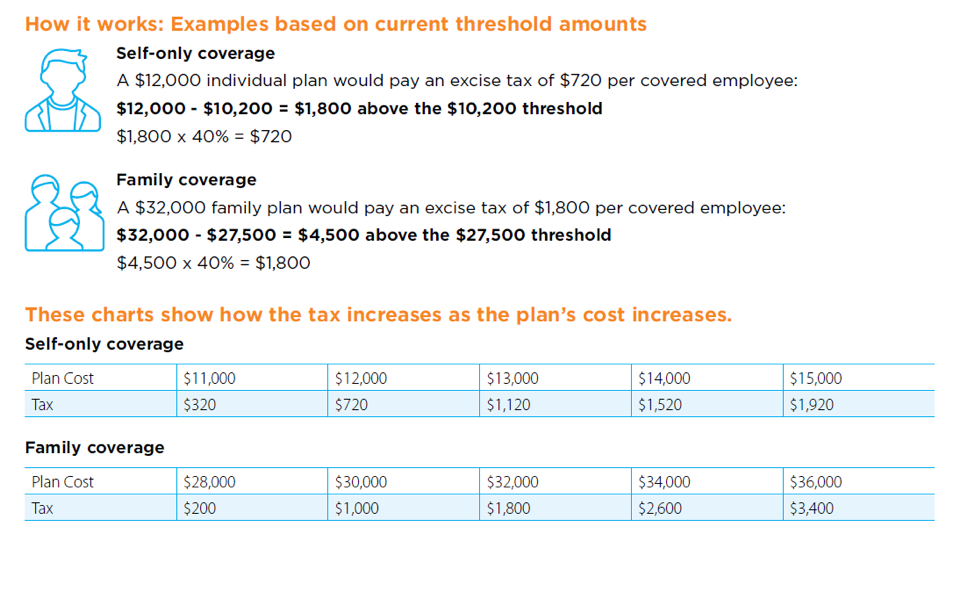

Whether you like the Affordable Care Act or not, it pays for itself and the Cadillac Tax was intended to play a big role. If it indeed goes into effect in 2020, employers who offer health plans that are more generous than those offered to the average consumer will be forced to pay higher taxes. The companies with these more generous plans will either have to pay the tax to keep them, pass along the extra expense to employees, or redesign their health plans so their costs fall under the tax exempt threshold ($10,200 or less for individuals and $27,500 for families) to avoid it. The Cadillac Tax was staged to go into place in 2018 and according to a Kaiser Family Foundation survey large companies (more than 200 employees) were already looking at ways to minimize its effects by making changes to their plans. Roughly 25% of employers were expected to be affected in 2018. That figure was expected to increase to 42% by 2028. Take a look at the below graphic to see how the tax is calculated.

So why the Bipartisan thumbs down?

Both republicans and democrats alike have called for a complete repeal of the Cadillac Tax, not just a delay. Democrats are siding with the unions who have historically negotiated high benefit packages for their members. This tax will make it harder to do that. Employers will likely cut health benefits to avoid the tax or pass those costs along to employees, who are already dealing with rising premiums. Workers will have their benefits cut. It’s not a popular position during an election year no matter what side of the aisle you’re on, but the tax doesn’t just incent employers to keep plans at a lower cost threshold.

It incents both workers and health care providers to naturally adjust their thinking in order to make wiser health care spending decisions once they have skin in the game. Currently consumers often don’t look into the costs of procedures because they aren’t paying for it. This phenomenon was intentionally addressed in this tax. It forces individuals to take on more responsibility for their health care costs as employers reduce the size of the plans in order to avoid the tax.

Within the letter economists argue, “The excise tax will discourage the provision of insurance that covers such a large proportion of health care spending that consumers have little incentive to insist on cost-effective care and providers have little incentive to provide it. As employers redesign health insurance plans to hold costs within the tax-free amount, cash wages or other fringe benefits will increase.” Whether employers will truly issue the money they save back to the employee as compensation is yet to be seen.

The reality is the tax frankly works a little too well

In a CNBC report, Larry Levitt, senior vice president of Kaiser Family Foundation added, “the tax is ‘so powerful’ in controlling health-care inflation as well as providing revenue used to expand health coverage under Obamacare that it will be difficult politically to get Congress to agree on a full-scale repeal of the tax.” Take a look at estimated tax revenue over time via the graph below. As health care plan costs increase, so does revenue.

Committee for a Responsible Federal Budget chart extrapolating federal revenue from the Affordable Care Act’s “Cadillac Tax,” based on Congressional Budget Office projections. Committee for a Responsible Federal Budget.

While the tax wasn’t repealed, the delay will give Congress time to refine it. If it’s not going to be the Cadillac Tax, it has to be responsibly replaced with something else. Maya MacGuineas, President of the Committee for a Responsible Federal Budget, writes in this WSJ blog, “An ideal option would be to replace the Cadillac Tax with a more direct change to the existing tax benefits for employer-provided health care.” Currently employers don’t have to pay taxes on the health care benefits they provide. It is a tax-deductible expense. She adds, “We could reform the health-care exclusion by scaling it back or eliminating it and use the money to both pay for health care and tax reform, all while helping to keep down growth in health-care costs. Such a change would level the playing field between wages and health benefits, which is better for workers.” The idea would take an act of Congress and it too would be unpopular.

If any newly proposed idea doesn’t have the political acumen to gain overflowing support, then what’s in place could remain for 2020 but with revisions that may include tying cost thresholds to medical inflation versus standard inflation over time and considering geographic differences that result in some plans being more expensive than others. Will the Cadillac Tax survive its new 2020 deadline? Only time will tell.